Credit Card Calculator

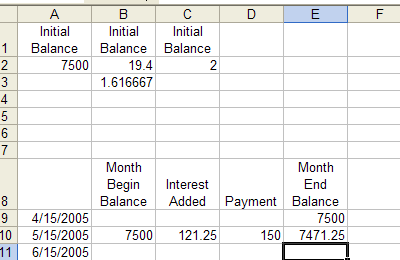

In this assignment you'll use Excel to do a simulation of how a credit card can work. This will be a near "worst-case" scenario. You will learn how high interest rates and low monthly minimum payments can lead many people into a trap. (1) Begin a new Excel spreadsheet. (2) Type the following data into the indicated cells. |

| Cell | What to type | Why you typed it. |

| A1 |

Initial Balance | It's just a column heading |

| B1 |

Interest Rate (%) | " |

| C1 |

Minimum Payment (%) | " |

| A2 |

7500 | Initial credit card balance of $7500 |

| B2 |

19.4 | Yearly interest rate of 19.4% |

| C2 |

2 | Minimum monthly payment of 2% of balance. |

| B3 |

=B2/12 | Divided yearly interest rate into monthly interest

rate. |

(3) In cells A9 and A10 we're going to type our first two billing dates. The first billing date will be the 15th of next month and the second will be the 15th of the month after that. Select cells A9 and A10 and fill down to row 500 or so. (4) Then type these headings |

| Cell | What to type | Why you typed it. |

| B8 | Month begin balance | It's just a column heading |

| C8 | Interest added | " |

| D8 | Payment Due | " |

| E8 | Month end balance | " |

(5) Type these formulas

| Cell | What to type | Why you typed it. |

| E9 | =A2 | Copies the value from cell A2 into cell E9 |

| B10 | =E9 | Copies the value from cell E9 into cell B10 |

| C10 | =B10*($B$3%) | Calculates amount of interest to add |

| D10 | =B10*($C$2%) | Calculates minimum monthly payment due. |

| E10 | =B10+C10-D10 | Calculates monthly ending balance. |

At this point this is what you should see:

All of the numbers in cells B10, E10, D10 and E10 are the results of the formulas you typed in step 5. (6) Fill cells B10 to E10 all the way down the column. Format all cells as currency as appropriate. Make sure dates in column A are formatted to show the year. (7) Clean up and make it look pretty. Use colors to make sheet easier to read. Make sure all columns are appropriate widths. (8) Save and TURN IN. |